Main Street Lending Program Wraps Up

A Midwest fitness chain with 400 employees and 10 locations faced collapse in 2020 as COVID closures erased membership revenue. A $10 million Main Street Lending Program (MSLP) loan in 2021, alongside early PPP funds, kept trainers employed and funded outdoor spaces and virtual classes. By 2023, memberships jumped 30% above pre-pandemic levels, with two new locations added. The loan, refinanced in 2024, turned survival into a fitness boom.

A provider of summer camps and international music performance tours, like many other businesses, faced immense challenges during the pandemic, requiring immediate financial relief to sustain operations. Through early access to PPP loans and later securing an MSLP loan of approximately $2.5 million, the company was able to stabilize, retain key staff, and continue delivering transformative experiences to thousands of young people.

A small business engaged in fabrication of materials for trade shows, an industry severely impacted by COVID-19 faced over $2 million in project cancellations in 2020-21, leading to increased operational costs and cash flow challenges. With the help of MSLP, the company was able to fulfill pre-pandemic commitments, sustain its workforce, and invest in marketing and infrastructure to drive long-term growth. This financial support not only helped the business navigate short-term disruptions but also enabled it to expand its client base, position itself for future profitability and successfully refinance MSLP loan in mid-2023.

Scores of businesses thrived thanks to the Main Street Lending Program (MSLP), a lifeline during COVID-19. The rigorous lending process ensured proper risk management while allowing financial institutions to strengthen relationships with borrowers navigating post-pandemic recovery. This successful collaboration between businesses and lenders underscored how well-structured financial programs can drive economic resilience while maintaining sound banking practices.

As the Main Street Lending Program (MSLP) approaches its final chapter, borrowers, lenders, and stakeholders are preparing for the significant challenges and opportunities that lie ahead.

The loan structure—featuring deferred principal payments until Year 3 (15%), Year 4 (15%), and a balloon payment of 70% at maturity in Year 5 (2025)—means that banks and the Fed are now bracing for a wave of maturities and potential defaults over the next nine months. With the program’s five-year maturity in Dec 2025 just around the corner, many borrowers are grappling with a looming 70% balloon payment at maturity and seeking strategies to navigate this critical juncture.

Banks are constrained in their ability to restructure MSLP loans. While some flexibility exists (e.g., extending payment deadlines within the five-year term with Fed consent), the program’s sunset in December 2025 marks the end of the Fed’s direct involvement. The Fed lacks the infrastructure to manage distressed loans beyond this date and is unlikely to extend the program, forcing banks to either absorb losses, execute loan sale with Fed approval, or pursue recoveries independently. Unlike traditional loans, banks cannot easily roll over MSLP debt due to the Fed’s SPV ownership, pushing borrowers toward alternative, often costlier, financing like private credit.

Since 2020 SRA Consults has assisted banks and borrowers navigate the MSLP program and have supported MSLP transactions as described above. Based on this experience let’s examine the program’s journey, credit quality performance, and the options available for lenders and borrowers as they confront this pivotal moment.

The MSLP Journey and Credit Performance

The Federal Reserve launched MSLP in 2020 to provide essential credit to mid-sized businesses that were too large for Paycheck Protection Program (PPP) loans but too small for corporate bond markets. The program facilitated over 1,830 loans totaling $17.5 billion, with the Federal Reserve purchasing 95% of each loan while banks retained 5%.

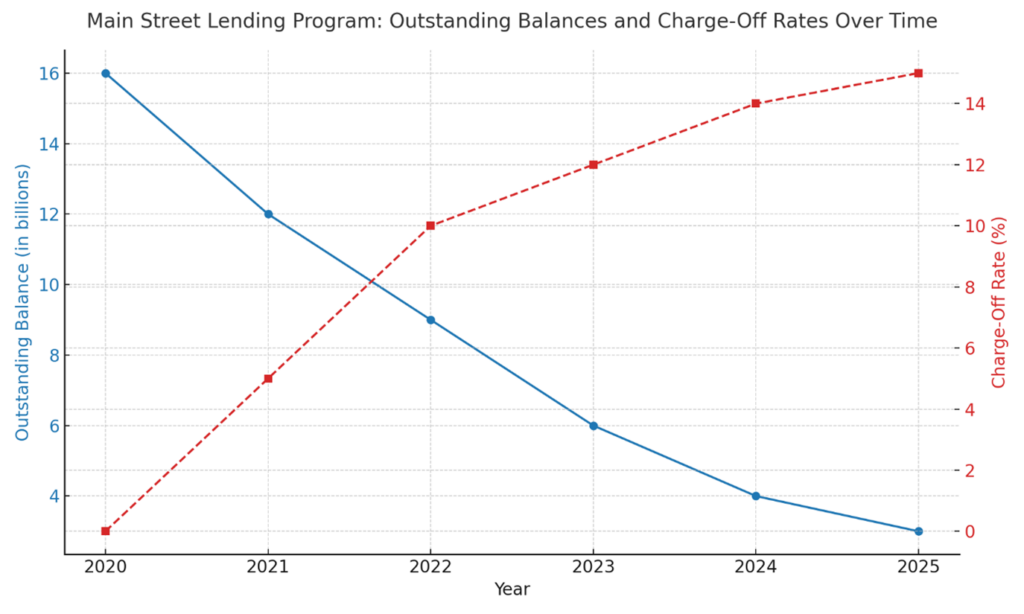

As of Feb 28, 2025, the outstanding balance had declined to $3.1 billion driven by scheduled repayments, payoffs and charge-offs.

Cumulative loan losses have surged from $198 million as of Dec 2023 to $1.4 billion by Feb 28, 2025, primarily driven by small businesses facing higher repayment burdens.

Source: Main Street Lending Program, Federal Reserve

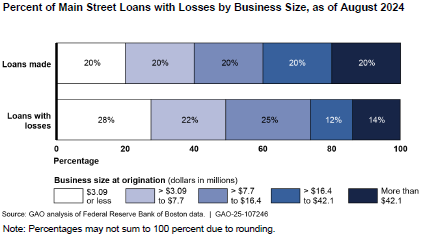

According to the latest GAO report, as of August 31, 2024:

- Small businesses face disproportionate losses – Borrowers with under $3.1M in revenue represent 20% of loans but 28% of charge-offs, whereas larger businesses with over $42.1M in revenue also hold 20% of loans but only 14% of charge-offs.

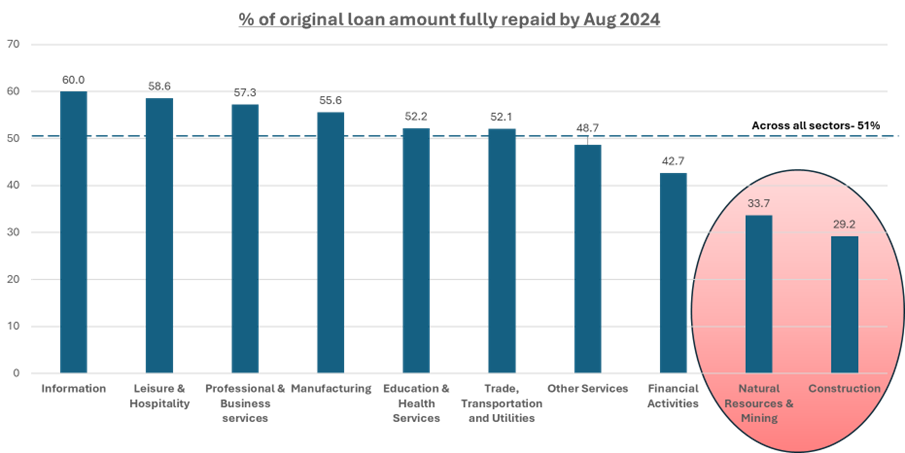

- Across all sectors, the percentage of fully repaid loans varied significantly. This is symptomatic of credit quality and correlates with cumulative charge-offs and delinquency rates.

- The information sector and the leisure and hospitality sector had the highest percentages of fully repaid loans, at about 60.0 and 58.6 percent, respectively, by dollars of loans repaid.

- In contrast, the construction and natural resources/mining sectors had the lowest percentage of fully repaid loans, at about 29.2 and 33.7 percent respectively.

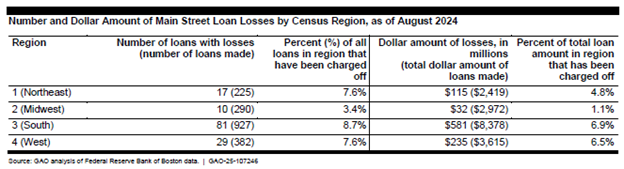

The South sees the most losses, with 81 loans charged off for a total of $581M, reflecting a 9% charge-off rate by loan count and 7% by loan value.

- MSLP’s estimated credit loss allowance increased to $729M as of Dec 31, 2024, and actual cumulative losses reached $1.35B as of Jan 31, 2025, reflecting ongoing financial stress among borrowers.

- Service-providing industries are hit hardest, with trade, transportation, and utilities sectors experiencing the highest number of loan losses, while financial activities companies have suffered the highest charge-offs by dollar amount ($213M).

- Construction and financial activities sectors lead in charge-off rates, with 12% and 11% charge-off rates, respectively, compared to the 3-6% range for most other industries.

These figures underscore the urgency for lenders to offer refinancing solutions to businesses struggling to meet their MSLP obligations.

A Looming Issue: 70% Balloon Payment

One of the most pressing challenges for borrowers is the 70% balloon payment due upon maturity. For many businesses, this significant lump sum poses a daunting hurdle, especially in an economic environment marked by rising policy uncertainty, looming tariffs, still elevated interest rates and uneven recovery across sectors. Borrowers who have yet to refinance or restructure their loans face heightened pressure to devise solutions as the Dec 2025 deadline approaches.

The Refinancing Imperative for MSLP Lender Banks

With rising interest rates and tightening credit conditions, many borrowers are actively seeking alternatives to manage their balloon payments. Banks that proactively engage in refinancing MSLP loans can benefit in multiple ways:

- Strengthening Customer Relationships: Providing refinancing options allows lenders to maintain long-term relationships with borrowers and capture future business opportunities.

- Mitigating Credit Losses: Refinancing loans before borrowers default can significantly reduce charge-offs and provisioning costs.

- Optimizing Capital Utilization: Transitioning MSLP loans to more sustainable financing structures can free up capital for new lending opportunities.

- Enhancing Portfolio Quality: Converting high-risk MSLP loans into structured long-term financing reduces balance sheet stress and regulatory scrutiny.

Refinancing Strategies for Lenders

Lenders can employ various strategies to help borrowers manage their MSLP debt effectively:

1. Traditional Loan Refinancing

- Convert MSLP loans into term loans with extended maturities (5–10 years) and fixed interest rates to ease repayment burdens.

- Target businesses with strong post-pandemic recovery trajectories and stable cash flows.

2. Asset-Based Lending (ABL) Solutions

- Offer refinancing secured by receivables, inventory, or equipment to improve collateralized lending.

- Particularly effective for borrowers in industries with high working capital needs (e.g., manufacturing, retail, and logistics).

- Offer refinancing secured by receivables, inventory, or equipment to improve collateralized lending.

- Particularly effective for borrowers in industries with high working capital needs (e.g., manufacturing, retail, and logistics).

3. SBA Loan options

- Borrowers may qualify for SBA 7(a) or 504 loans as a refinancing option.

- SBA loans offer longer repayment terms and lower interest rates, easing cash flow constraints.

- Refinancing MSLP loans with SBA-backed financing can provide businesses with a fresh start while reducing financial strain.

4. Note sale to 3rd parties

- Provide exit capital to the remaining borrowers in the Program through direct loans or loan note purchases from participating banks/FED. Participating banks and the FED are selling loans through an independent auction process to note buyers who are not related to the borrowers in any way. Cares Act specifically prohibits granting borrowers debt forgiveness, but an independent note buyer can purchase a note at a discount if the purchase price is above the borrower’s liquidation value. Loans are currently being sold through Debt-X and investment bankers.

5. Private Credit and PE Partnerships

- Facilitate third-party investments, including private equity-backed financing solutions, to inject capital into distressed but viable businesses.

- Partner with alternative lenders to syndicate refinancing opportunities and diversify risk.

Opportunity to Partner

The MSLP has demonstrated its effectiveness in stabilizing mid-sized businesses post-pandemic. However, as maturity deadlines loom, lenders must act swiftly to support borrowers in restructuring their obligations. The surge in defaults and charge-offs signals that proactive refinancing is not just a growth opportunity—it’s a necessity.

At SRA Consults, we specialize in MSLP loan refinancing solutions tailored to banks and financial institutions. If your institution is looking for strategic refinancing options or structured loan workouts, contact us today to explore innovative solutions that protect your portfolio while strengthening client relationships.

Now is the time to take action—partner with SRA Consults to navigate the MSLP transition successfully. Reach out to Amitabh Bhargava (abhargava@sraconsults.com) and Bert Knotts (aknotts@sraconsults.com)