Beyond the Coastline: How Asheville’s Hurricane Helene Devastation Redefines Climate Risk for Inland Communities

The heartbreaking scenes from Asheville post-Hurricane Helene underscore a critical reality: climate risk isn’t just a coastal issue. Flooded businesses, crippled infrastructure, and residents struggling for basic necessities paint a picture of widespread devastation. This isn’t just a humanitarian crisis; it’s a financial one, too.

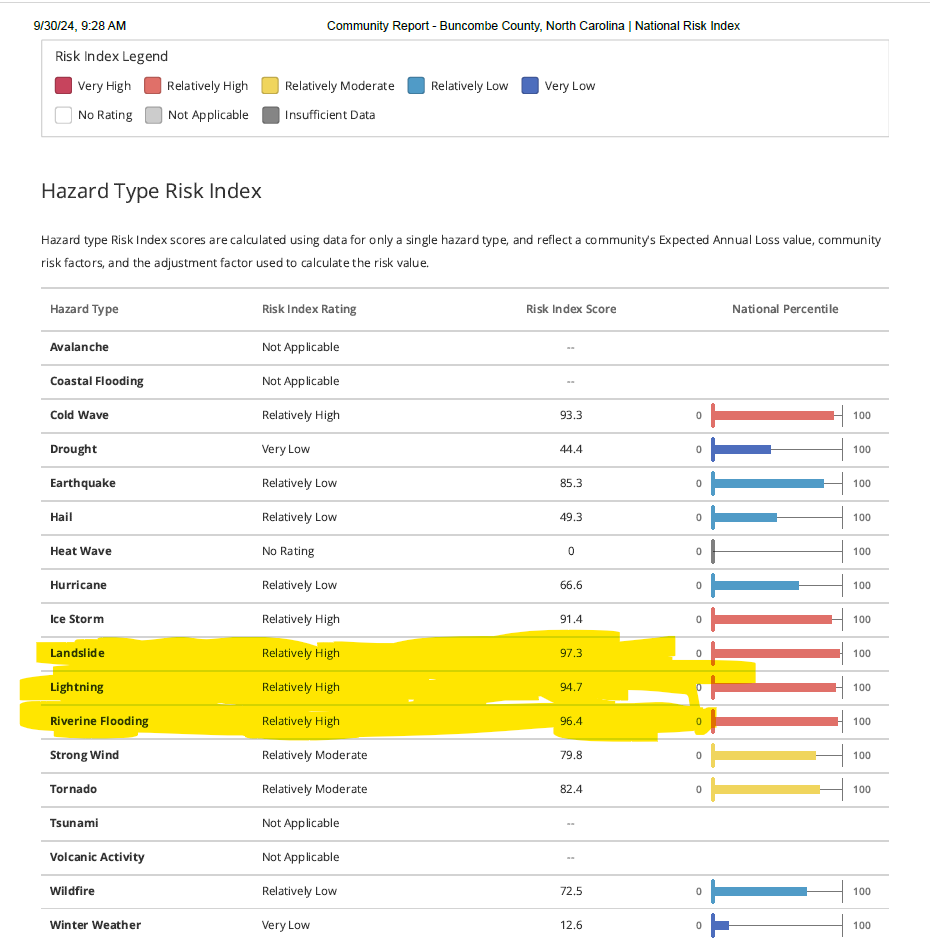

Was it as big a surprise as is being made out? A 500 Year event !! Really?

According to FEMA’s National Risk Index, Asheville carries a Relatively High risk for riverine flooding with a risk score of 96.4—making it one of the most flood-prone areas in the country. Asheville’s “Relatively High” riverine flood risk, tragically materialized. The resulting loan defaults, property devaluation, and business interruptions send shockwaves through financial institutions’ balance sheets.

For banks and credit unions, these climate hazards present both a challenge and an opportunity. While physical damage to infrastructure is apparent, there is a growing need to protect the financial stability of the communities we serve. Flood insurance is a crucial safeguard for local businesses and homeowners alike, and as we’ve seen, the lack of it can result in devastating financial loss.

Flood Insurance Awareness: It’s imperative that individuals and businesses – especially those in high-risk areas like Asheville—understand the importance of flood insurance. Many are unaware of the high risk they face. On the other hand— not everybody needs to panic. Focus on data. Believe in Science.

Climate risk IS credit risk: Helene’s impact on Asheville proves that extreme weather events, even inland, can trigger significant financial losses.

Risk Diversification: As Hurricane Helene has shown, regional disasters can quickly spiral into large-scale financial disruptions. Diversifying loan portfolios and working closely with clients to mitigate risks can help cushion the financial blow when future events occur.

But Diversification isn’t enough: Geographic spread alone can’t protect portfolios. A nuanced understanding of climate-related hazards is essential.

Proactive risk management is key: Integrating climate risk assessment into underwriting, stress testing, and portfolio management is no longer optional. It’s crucial for long-term stability.

For banks and credit unions looking to stay ahead of climate risks, understanding localized hazards like those in Asheville/Buncombe County is critical. If you’d like to explore how your institution can better assess and manage climate risk, feel free to reach out. Together, we can build a more resilient financial system in the face of increasing natural disasters.