Construction Lending in 2025: When Cost Uncertainty Meets Credit Risk

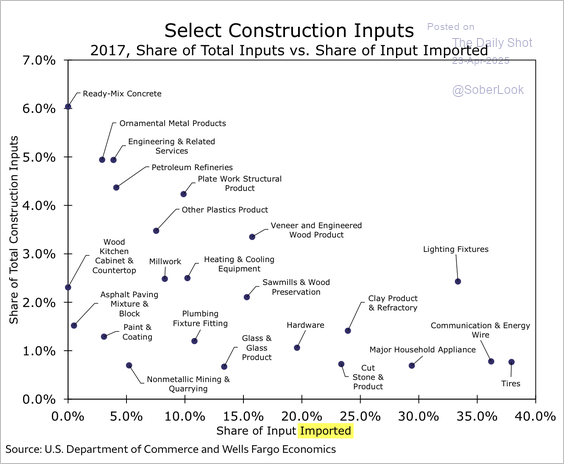

In the dynamic world of real estate finance, few sectors are as exposed to macroeconomic shifts as construction lending. A recent review of The Daily Shot highlighted a compelling chart showing just how much the construction industry relies on imported inputs — from HVAC systems and plumbing components to lighting fixtures and ceramic tiles.

Paired with the latest Turner Construction Cost Index, which indicates that construction costs remain approximately 27% above pre-pandemic levels, these data points raise significant red flags for lenders heading into the rest of 2025.

Why Should Lenders Be Concerned?

Many community and regional banks have meaningful exposure to construction loans — particularly in fast-growing metro and suburban markets. While inflation has stabilized somewhat, the challenge ahead is no longer just about higher prices. It’s about availability.

If tariffs are reimposed or global supply chains remain brittle, even a single delayed shipment of key materials can push a project off track. And in construction lending, delays aren’t just inconvenient—they’re financially dangerous.

The Historical Risk Profile of Construction Loans

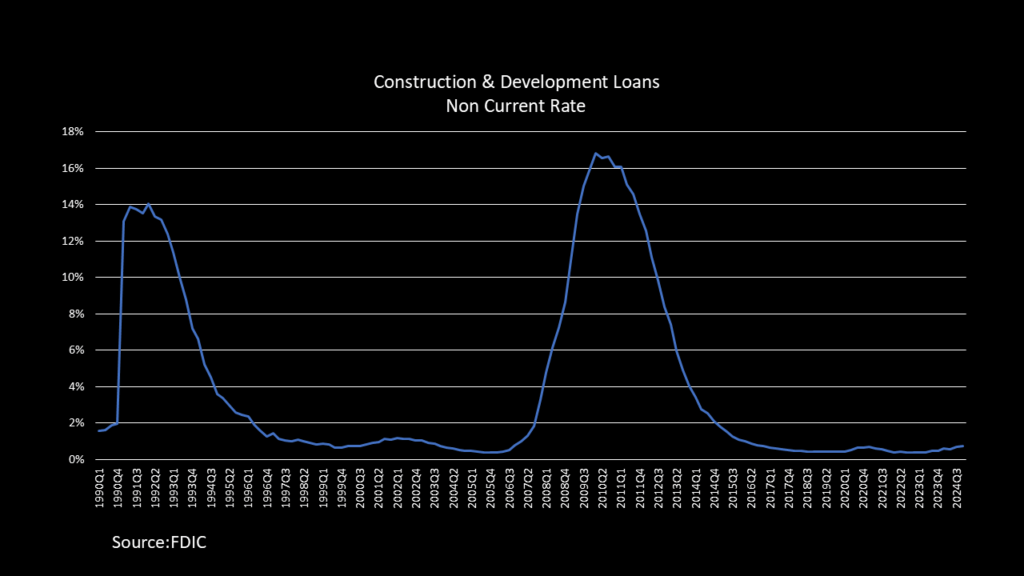

Construction lending has long been one of the most volatile asset classes within commercial real estate. Consider this:

- In the wake of the 2008 financial crisis, construction loans saw some of the highest nonaccrual and net charge-off rates across bank balance sheets.

- Even during non-recessionary periods, this loan category often carries binary completion risk — either the project is delivered on time and within budget, or it’s at risk of material value impairment.

Why 2025 May Be Especially Challenging

Several structural headwinds are converging this year, making credit risk management in construction lending even more critical:

- Tariffs on imported building materials could raise input costs sharply, particularly for items not easily sourced domestically.

- Supply chain disruptions remain a threat, with lead times still elevated in many categories.

- Skilled labor shortages are pushing up wage costs and delaying project timelines.

- Land and entitlement costs—already embedded in most pro formas—leave little cushion for overruns.

Implications for Credit Risk Teams

In this uncertain environment, lenders must take a more surgical approach to underwriting and portfolio oversight:

- Stress test construction budgets for both cost and timeline shocks.

- Scrutinize sponsors’ liquidity and their ability to bridge delays.

- Be wary of speculative developments, particularly those without pre-leasing or fixed-price contracts.

- Consider exposure to markets or asset classes highly dependent on imported construction inputs.

A Strategic Response: Partnering for Portfolio Resilience

Given the elevated risk environment, now is the time to reassess construction lending exposures. Lenders who proactively manage portfolio risk and recalibrate underwriting standards will be better positioned to avoid the pitfalls of past cycles.

At SRA Consulting, LLC, we specialize in credit portfolio management services that help banks and non-bank lenders:

- Detect emerging risks across construction and CRE portfolios

- Refine risk appetite frameworks and sector limits

- Support underwriting teams with stress testing and sponsor analysis

- Strengthen early warning systems and loan review functions